What Is a Margin Call?

You have an investment account, and it includes a generous margin loan amount. A sudden 15% drop in the stock market causes your broker to call you and tell you that you need to put up more cash or securities. Your equity in your brokerage account has fallen below the dreaded 30% mark.

You’ve just had a margin call.

What Is a Margin Loan?

Very simply, a margin loan is a loan that the investment broker extends to the investor. It is secured by investment securities held in the investor’s account which is held with the same investment broker.

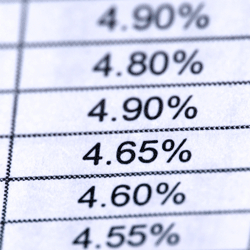

Margin loan rates are usually based on the prime rate or some other interest rate index, and then a margin is added to that rate and varies depending on the size of the investor’s account. For example, someone with $1 million dollars on deposit with the investment broker will get the lowest rate, where someone with a $10,000 account balance may pay several percentage points more.

A margin loan is a not a loan that needs to be paid back. It’s much more like a revolving credit line secured by your investment securities, that you can pay back on your own timetable, or when you sell your security positions.

Advertisement

The broker will allow you to borrow, or margin, up to 50% of the value of the stocks or other securities you are buying, or of the value of your account at any one time. There is also a minimum investment equity value of at least 30% of your holdings. If the value of your investment holdings drop below 30% (put another way, 70% of your securities are margined out), a margin call to the investor will be issued by the broker.

Why Would Anybody Do That?

Just as is the case with real estate investing, securities investors sometimes use leverage to increase their investment returns.

If an investor has $50,000 in a brokerage account, he can use a margin loan to buy up to $100,000 worth of securities. In a rising stock or bond market, that kind of leverage can nearly double your investment returns.

Should the stock market double in five years, a $50,000 investment will rise to $100,000, giving the investor a $50,000 return. But if a margin loan is used to purchase $100,000 of stocks, it will rise to $200,000, giving the investor a $100,000 gain, less the cost of margin interest over the five year term.

Now, About That Margin Call

If an investor’s equity in his account drops below 30%, the broker will issue a margin call to the investor requiring either that he deliver more securities (increase overall account value) or pay in cash (reduce the margin loan amount).

The account can drop below 30% for two primary reasons. Either the value of the investment securities fall, or the investor withdraws cash, or a combination of both. This situation is complicated by the fact that many investment accounts have check writing privileges or can be accessed for cash with a debit card. If the cash drawdown coincides with a drop in equity values, and causes the net equity in the account to drop below 30%, a margin call will be the outcome.

That’s Why Most People Don’t Do It

Conservative investors generally avoid margin loans, and most investors will keep the loan balances at a level that’s well below 50% of the account value.

Just as there’s great upside income potential from margin loans in rising markets, the ride down can be made much worse.

If you have $100,000 in investment assets, 50% of which is margin loans, and the market drops by 20%, you will lose $20,000. That’s twice the amount you would have lost if you didn’t use a margin loan, and kept your investment holdings at $50,000.

How to Avoid Margin Calls

The first, best way to avoid margin calls is not to use margin loans in the first place.

Next, keep your use of margin loans on the low end of your borrowing limit. Instead of borrowing 50% of your investment value and risking an eventual margin call, limit your leverage to no more than 10-20%. You’ll have some leverage to improve your performance in a rising market, but not enough to trigger a margin call.

Consider the securities in your portfolio. Bonds and dividend paying blue chip stocks are less likely to fall dramatically in value and to result in a margin call.

Market timing is another consideration, but it’s much harder to gage. Using margin loans when the market is coming off a five year bull run and starting to stumble isn’t a good idea. But using it after a significant market drop after which the market seems to be stabilizing could be worth doing in small amounts.

Do you use margin loans? Do you recommend it for other investors?

Leave a comment